About Premio Plus Card

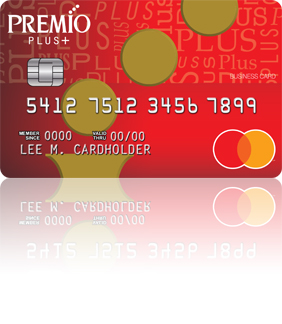

Premio Plus Card

Premio Plus Card

A Cash Back Rewards Credit Card

Premio Plus+ is here to help make your life in the United States as comfortable as it can be. You can take advantage of the same benefits that our basic Premio card has to offer while earning cash back for your everyday purchases. You earn 1% back on everyday purchases such as groceries, gas, online shopping, gym memberships and more!

There is no limit to how much cash back you can earn. Points will expire on or after the third anniversary of when they were awarded. You can redeem for $25 each time 2,500 points have been earned. You can choose to receive your $25 as a check, a statement credit or as a direct deposit to a U.S. checking or savings account.*

Must apply here for this offer. Offers vary elsewhere.**

$0 Intro Annual Fee for the 1st year(after that $50 annually)*1

> Summary of Credit Terms

Additional Benefits

No Credit History Needed

You can apply for the card without having a credit history in the United States.

In the United States, it is very difficult to qualify for a credit card if you just moved from another country and have no credit history. We have a unique review process that allows us to accept applications for our credit cards even if you have just arrived to this country and have no credit history. Card issuance is subject to credit approval.

No Foreign Transaction Fee*1

Most cards charge 3% of a transaction amount on purchases made outside of the U.S. but the Premio Plus card has no Foreign Transaction fee.

24 hour Bilingual Emergency Support

Japanese and English emergency customer support 24 hours a day.

Online Banking

Online banking services make it easy to manage your account wherever you are.

You can schedule and confirm payments, review statements, check your current balance and much more. You can manage your account anytime from your computer, tablet or mobile phone when you need it the most.

MasterCard Business Card Benefits*2

Premio credit cards offer various MasterCard services that are normally only provided to businesses and you can now enjoy these benefits through your Premio Plus+ credit card.*2

These benefits include

Mastercard Global Services

Mastercard will notify the card issuer within 15 minutes of you reporting your card missing and arrange delivery of a replacement card to you anywhere in the world.

Mastercard ID Theft Protection™

Cardholders will have access to enhanced Mastercard ID Theft Protection™ to monitor their information.

Easy Savings

A program that provides eligible cardholders access to automatic savings on every day expenses from travel to dining and business services. Click here to learn more.

Receipt Management Mobile Application

Mastercard will provide a mobile app to help cardholders track paper and digital receipts, capture key purchase data, categorize their expenses, and view/export customized reports.

**Offers may vary depending on where you apply, for example online or in person. To take advantage of this offer, apply now directly through this advertisement. Review offer details before you apply.

These services are provided by MasterCard to card members. Please see the MasterCard Corporate Payment Solutions Guide to Benefits for details. These services by Master Business card are available in English only.

By applying for the credit card, you understand and agree that all disclosures and other important documents related to the card that are required by law will be provided to you only in English. If you are unable to read and understand the English language, it is very important that you seek the assistance of a trusted, qualified person who can translate these disclosures and important documents for you.

Please see the Summary of Credit Terms for important information on rates, fees, costs, conditions and limitations.

* See the Credit Card Reward Terms and Conditions in the Summary of Credit Terms for details including earning, redemption, expiration, forfeiture, and other limitations. Cash back accumulates as points and is redeemable in $25 (2,500 point) increments.

*1 For additional information about Annual Percentage Rates (APRs), fees and other costs, see Summary of Credit Terms.

*2 Complete program details including restrictions, limitations and exclusions, will be provided when you become a cardmember.

Cards are issued by First National Bank of Omaha (FNBO®), pursuant to a license from Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.